pay personal property tax richmond va

101KB Personal Property Tax Relief Act of 1998. The county also can consider high mileage and damage beyond regular wear and tear in assigning values to vehicles.

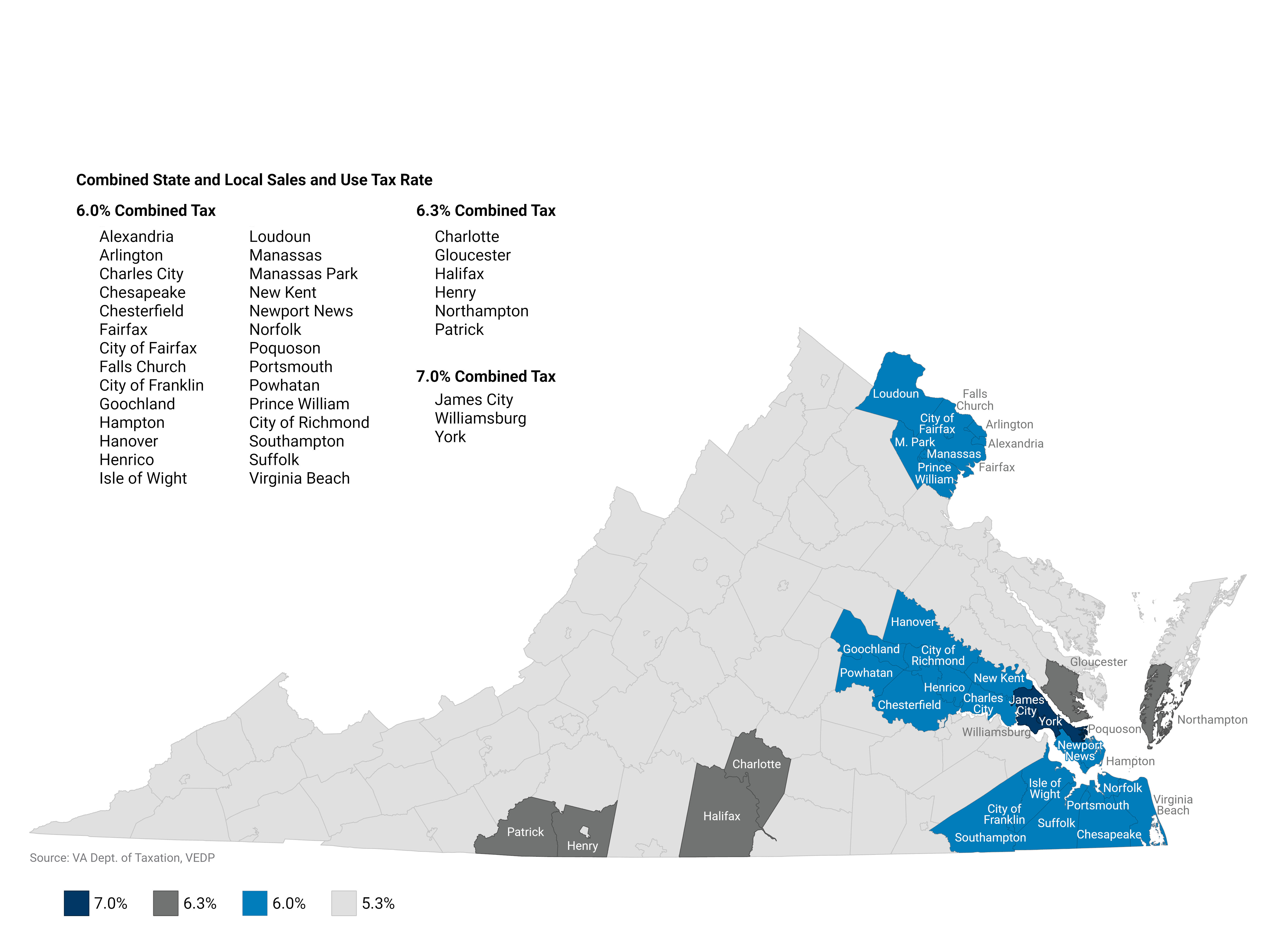

Virginia Sales Tax Retail Tax Increase Virginia Cpa Firm

Credit for Taxes Paid to Another State - Supporting Forms.

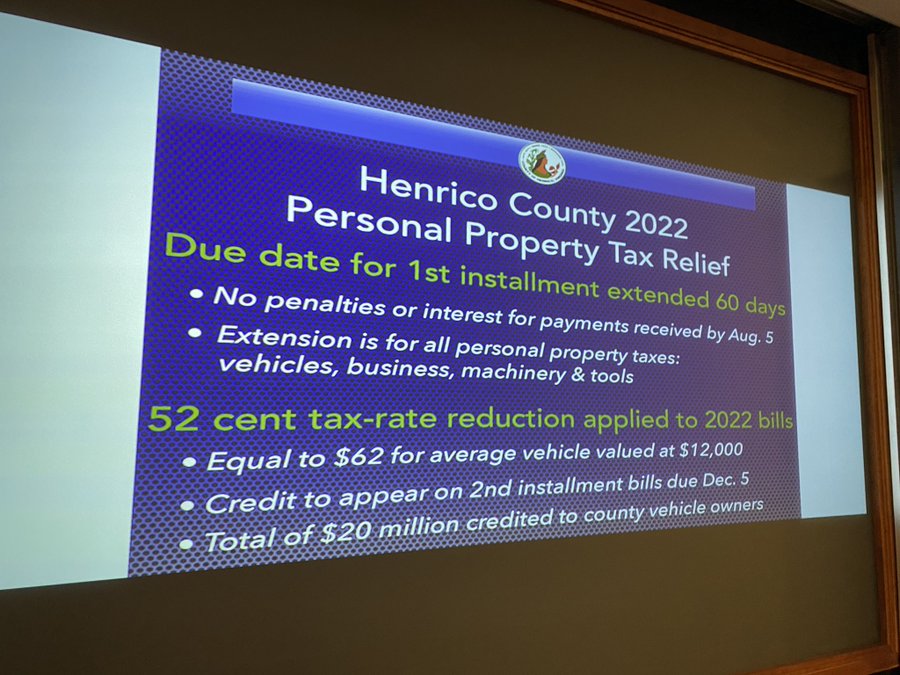

. Department of Finance 4301 East Parham Road Henrico VA 23228. Parking tickets can now be paid online. Personal Property Tax Relief.

Stafford VA 22555. The Personal Property Tax Relief Act of 1998 provides tax relief for passenger cars motorcycles and pickup or panel trucks having a registered gross weight of less than 7501 pounds. Virginia Department of Taxation.

Return to pay personal property taxes online screen. PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL. Personal Property Registration Form An ANNUAL.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Update address when you moved withinintoout of Stafford add purchased personal property remove soldtradeddisposed personal property. Farming.

You can make Personal Property and Real Estate Tax payments by phone. Low Income Individuals Credit. Box 90775 Henrico VA 23273-0775.

If you have questions about your personal property bill or. Personal Property Taxes are billed once a year with a December 5 th due date. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons.

May 27 2022 at 752 am. Real Estate and Personal Property Taxes Online Payment. To qualify a vehicle must be owned by an individual or leased by an individual under a contract requiring the individual to pay the personal property tax.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Make a Payment Bills Pay bills or set up a payment plan for all individual and business taxes Individual Taxes Make tax due estimated tax and extension payments. All cities and counties in Virginia have a personal property tax.

Annual property taxes are likewise quite high as the median annual property tax paid by homeowners in arlington county is 6001. Virginia Department of Taxation PO Box 1777 Richmond VA 23218. Personal property tax bills have been mailed are available online and currently are due June 5 2022.

Parking Violations Online Payment. Offered by City of Richmond Virginia. Team Papergov 1 year ago.

You have the option to pay by credit card or electronic check. Pay Personal Property Taxes in the City of Richmond Virginia using this service. Due to system maintenance the DMV website will be unavailable on Sunday May 29 from 1200 am.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes. Pay Real Estate Tax.

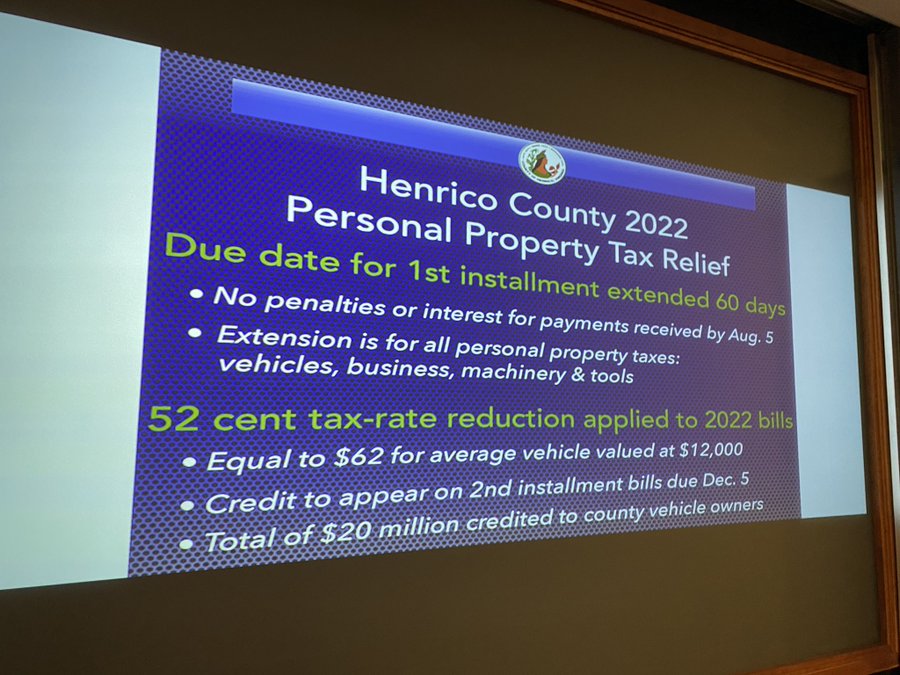

The personal property tax is calculated by multiplying the assessed value by the tax rate. AP A Virginia man pleaded guilty Thursday to charges that he failed to pay 13 million in taxes to the IRS by withholding payroll taxes from. In neighboring Henrico County where personal property tax rates are the lowest in the Richmond area at 350 per 100 assessed value leaders have proposed using a newly amended Virginia law that.

The current rate is 350 per 100 of assessed value. The Commissioner of Revenue assesses the tax while taxes are paid to the Treasurer. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

Does the leasing company pay the tax without reimbursement from the individual. Click Here to Pay Parking Ticket Online. Therefore the city has increased the amount of automatically applied Personal Property Tax also known as car tax Relief to offset our residents tax burden.

In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. For Personal Property Tax Payments Feel free to contact the office should you have any questions 804-333-3555. Pay Your Parking Violation.

Finance Main Number 804 501-4729. Pay Personal Property Tax Richmond Va. Call 804 646-7000 or send an email to the Department of Finance.

The personal property tax rate is determined annually by the City Council and recorded in the budget appropriation ordinance each year. Page County taxes 6 categories of property. There is a convenience fee for these transactions.

Box 27412 Richmond VA 23269. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

Many Left Frustrated As Personal Property Tax Bills Increase

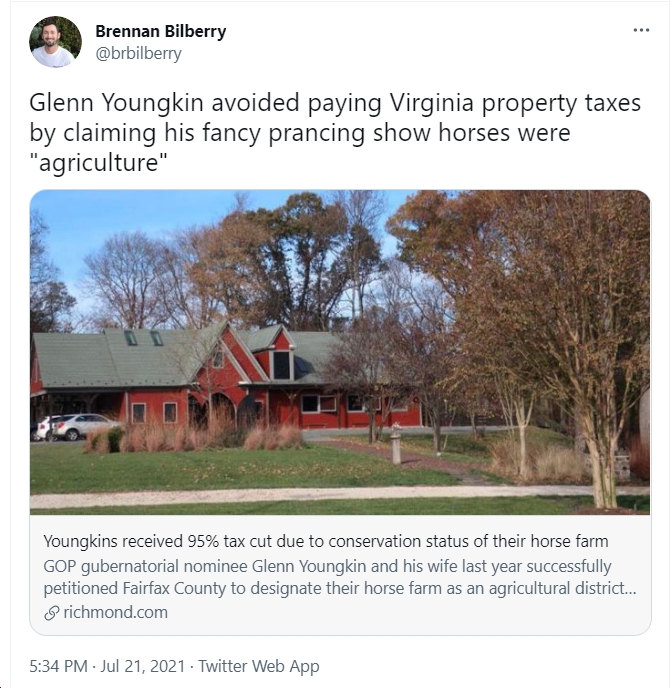

Using His Luxury Horse Farm To Dodge Property Taxes Glenn Youngkin Is Sounding More And More Like His Idol Donald Trump Every Day Blue Virginia

Pay Online Chesterfield County Va

I Received A Richmond Property Tax Text R Rva

Fill Free Fillable Port Of Richmond Virginia Pdf Forms

Fill Free Fillable Port Of Richmond Virginia Pdf Forms

Henrico County Announces Plans On Personal Property Tax Relief

Richmond Raises Tax Relief As Vehicle Values Surge Wric Abc 8news

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Fill Free Fillable Port Of Richmond Virginia Pdf Forms

Fill Free Fillable Port Of Richmond Virginia Pdf Forms

Henrico County Announces Plans On Personal Property Tax Relief

Many Left Frustrated As Personal Property Tax Bills Increase

Fill Free Fillable Port Of Richmond Virginia Pdf Forms

Fillable Online Business Tangible Personal Property Tax Return City Of Richmond Fax Email Print Pdffiller

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

Henrico County Announces Plans On Personal Property Tax Relief